The 50 Year Anniversary of The Great Monetary Upheaval

We are about to reach a milestone that is little considered by the public at large. It was 50 years ago, on August 15, 1971, that President Richard Nixon decided to take the US off the last remnant of the gold standard.

The facts are, as you will see, that a number of very important relationships and trends changed with that ill-fated decision. We invite you to visit a fascinating website https://wtfhappenedin1971.com/. or view the accompanying video. You must spend some time on the site to fully appreciate the enormity of the change generated by this monetary decision.

We don’t know the people who put this remarkable data set of charts together, but they have found quite an amazing number of trends that seem to shift substantially, right around the date of “closing the gold window.” And regrettably, most of those trends are bad trends for the nation.

What does “closing the gold window mean”? It means dollar holders could no longer redeem their paper currency for gold. That in turn means, the US government was no longer constrained in how much it spent or went into debt. It is truly a watershed event.

A little background is due.

The United States had been on a bimetallic standard (gold and silver) for most of its history. That meant the currency was “backed” by precious metals. In reality, usually gold was behind only about 40% of the money supply, and both the money supply and the supply of gold fluctuated.

Rather than get into the weeds about the mint ratios between gold and silver and other complications, we will just call the system we had the gold standard.

The system had sufficient gold that most people if they desired, could exchange their paper dollars for gold and silver any time they wanted. This was true of dollar holders inside the country, and those outside the country. People had confidence that money would hold its value and that government would financially behave itself.

If chronic inflationary policies were pursued by the government, domestic money holders would “vote” by converting their paper to metal. This contracted gold reserves, which served as base money, and the money supply would contract, ending the inflation.

In international terms, a country with a chronic trade deficit would lose gold reserves to foreigners who distrusted the policies, which likewise would contract reserves, lowering prices levels in the offending nation and bringing international trade balances back into balance.

In short, the classic gold standard was an automatic equilibrating mechanism, driven by voluntary action of market forces and a free people, which kept governments from running large fiscal deficits, chronic trade deficits, and using currency depreciation as a matter of policy.

This automatic system was preferred because political authorities had historically abused the monetary system for their own ends so frequently, that political management of money was not trusted.

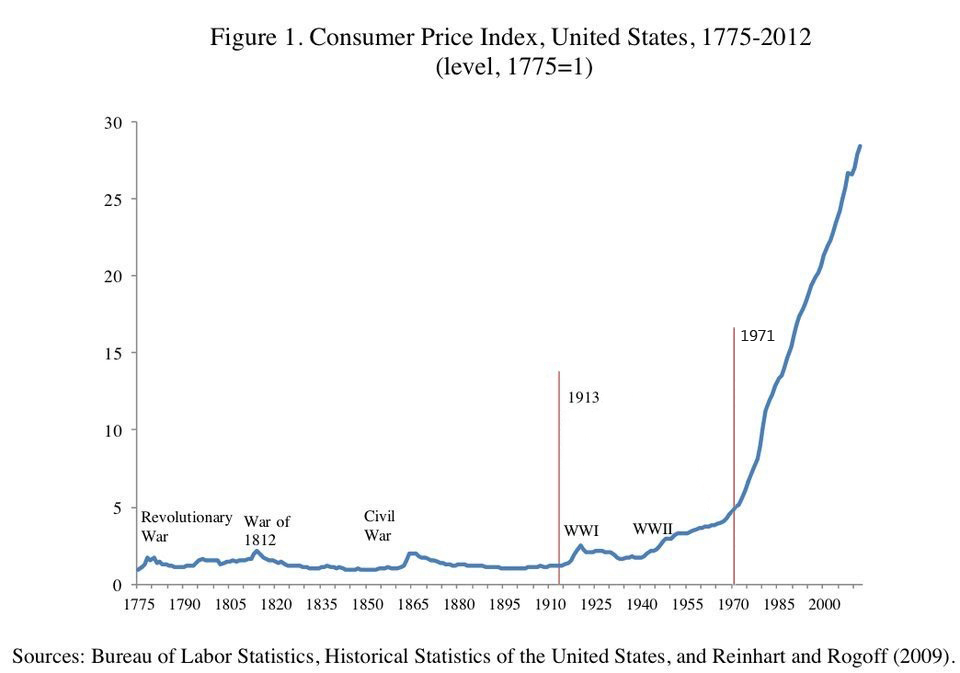

Based on this history, people trusted the mechanism of the gold standard more than they did the discretionary management of politicians. As you can see below in the chart, that trust was completely justified.

Most people knowing that the gold was there and that they could test the system at any time, had confidence that the dollar was “as good as gold”, and therefore were content to conduct the bulk of their commercial business in paper money, which actually functioned as warehouse receipts for the gold that stayed in the US Treasury. Thus, a gold standard does not require all transactions to take place with physical metals being exchanged. Analog or digital receipts for gold and silver worked fine, as long as people knew the gold was there in the event they desired to convert to the real stuff.

There had been temporary suspensions of this “convertibility” during the Civil War and such, but the system was quickly reinstated.

During most of this period, the price level in the US, and in other nations adhering to the international gold standard, fluctuated very little. A dollar worth x today would be worth x tomorrow, and five years from now, or fifty years from now. It was not uncommon to have gold clauses in long-term bonds and mortgages, meaning in the event of inflation, the creditor could be repaid in gold.

The result of all these arrangements was monetary stability. Here is a chart from the website previously cited.

Notice that whatever inflation we had was closely associated with wartime expenditures, and even then, it was modest and temporary. The pattern was to pay for the war, go through a period of austerity, and get back on track to near-zero inflation. Other than those minor fluctuations, it created centuries of stability.

However, Progressives disliked the gold standard for the same reason they disliked the restrictions of the Constitution. Like the effort to wriggle out of Constitutional limits to government size and power, they also wanted to wriggle out of the constraints of the gold standard.

A government that is limited in spending will be limited in size. Those that wanted a very large government, particularly one that would engage in redistributing income from one group to another, needed to break out of the bonds of both the Constitution and the gold standard.

Other critics of the gold standard noted that we had periodic booms and busts, and if the currency were made to be “elastic”, these fluctuations could be modulated. We would no longer have periods of high unemployment or so-called financial panics, or so they contended.

Progressives also had great faith in government experts and chafed under both Constitutional and institutional arrangements like the gold standard that limited their discretionary power. They wanted a currency that was managed by men to harness the government to “help” people. They wanted to do “central planning”, to harness the economy for their political ends.

So, it is not coincidental that the process of turning the Constitution into a “living, breathing document” corresponded with a number of steps to break down the classic gold standard.

In the case of gold, it really started after World War I, as Progressives took us to a “gold exchange standard”, a gold standard in form but not substance.

This was followed by FDR officially making gold illegal in 1934, and suspending the ability of citizens inside the country to convert their dollars to gold or to enforce gold clauses in contracts. This was done to inflate the currency to supposedly combat deflationary depression.

However, the ability of foreigners to convert their dollars to gold was maintained.

Another adjustment came in 1944 with the founding of the International Monetary Fund, at the Bretton Woods Conference. Since the dollar remained convertible for international trade, the dollar was made the lynchpin of a new system where every other currency would be “backed” by dollars, which by extension, was theoretically “backed” by gold.

By the late 1950s, and accelerating sharply thereafter with Kennedy’s New Frontier and Lyndon Johnson’s Great Society, Democrats put the nation into a system of “guns and butter.” In short, it put the nation into long wars in Vietnam with huge military expenditures, while growing the welfare state at home with huge new expenditures. By 1965, silver was removed from the monetary system.

Inflation acts rather like a compound interest curve in reverse, with money purchasing power falling at a faster and faster rate.

Deficits both fiscal and in trade began to grow much faster than gold reserves, and some nations took note and suspected the US could not meet its commitments. They began to convert their dollars to gold while they could.

They proved to be correct. The US defaulted unilaterally on its solemn treaty obligations because the outflow of gold became torrential. At the time of Nixon’s decision, he left a good deal of the decision-making in the hands of his Democrat Treasury Secretary John Connelly, the same Democrat governor of Texas shot in the car with President Kennedy.

Contemporary records show officials thought it would be temporary, and the U.S. as it had in the past would reinstate even this modified gold standard. The financial system groaned under the strain and price inflation began to become elevated and persistent. By the late 1970s, inflation reached levels of 10-12% per year.

However, in reality, after August 15, 1971, the country never looked back. No serious attempt was ever made to restore the previous system. We stumbled into an entirely “managed” system by experts who purportedly would act in the public interest and not be influenced by partisan politics or intellectual fashion.

What a cruel joke that turned out to be.

Tracing back to the Progressive project of the Federal Reserve in 1913, the current dollar is worth just 3 cents on the 1914 standard. As the chart shows, we moved from monetary stability to permanent instability. Only in Washington would that be considered good management.

Progressives did achieve, with help of many Republicans, a giant intrusive government, that spends most of its efforts moving money from one group to another. However, the promised economic stability never materialized. The faulted gold standard actually showed shorter and more shallow economic fluctuations than those that followed under the managed system. Thus, we wound up with both chronic inflation, economic instability, and a government so large it menaces our freedom.

Since 2000, the Federal Reserve has gone well outside of its traditional functions and began to buy huge quantities of government debt, all with money created out of thin air. This so-called “Quantitative Easing” has allowed a spendthrift Congress to develop even bolder spending plans. Further, any attempt to scale back their purchases of bonds threatens the stability of the financial markets, most of which have now become overvalued and addicted to a regime of ever-expanding credit at zero interest rates.

The nation is now embracing the principles of Modern Monetary Theory, which basically posits that the government can pay its bills by printing money. Taxes are used to remove money from circulation at a time when inflation is deemed out of hand by the experts.

Citizens are given an interesting choice: choke on inflation or high taxes.

But this is neither modern nor a cohesive theory. It is simply a high-tech version of the fiscal excesses of the Revolutionary War with the destruction of the value of money (not worth a Continental), the Civil War Greenback, or the actions of numerous Roman politicians, European and Asian kings, and contemporary Third World dictators.

We are now at a point where it seems if you are not spending a Trillion dollars, it is hardly worth cranking up the Congressional law-making machine. As a republic, we are even giving bananas a bad name.

Checks are sent out to the public, with money printed out of thin air, all in the name of Covid relief, or equity, or global warming. But while money can be created out of thin air, real production of goods and services cannot. So, we have too much money chasing too few goods, or classic monetary inflation.

With Congressional backbone missing, the Constitutional limits on government ignored, and no gold standard, we now are living the life feared by advocates of the gold standard. They argued at the time, that lacking a constraining institution, the public would soon learn to vote themselves unlimited benefits from the public Treasury.

The inflation genie is now out of the bottle as our managerial elites have lost all semblance of fiscal probity.

In the words of James Madison in Federalist #51:

But what is government itself, but the greatest of all reflections on human nature? If men were angels, no government would be necessary. If angels were to govern men, neither external nor internal controls on government would be necessary. In framing a government which is to be administered by men over men, the great difficulty lies in this: you must first enable the government to control the governed; and in the next place oblige it to control itself. A dependence on the people is, no doubt, the primary control on the government; but experience has taught mankind the necessity of auxiliary precautions.

The auxiliary precaution insofar as government finance was concerned, was the strictures of the gold standard.

The last remnant of that restraint was abandoned 50 years ago, on August 15, 1971.