Inflation Can Be Difficult To Kill Off

It is difficult to find exact historical settings for the inflation set loose by the Biden Administration. However, the similarity with previous periods could be a guide.

Among the conditions plaguing us today are: very turbulent domestic politics, large deficits caused by an expansion of the welfare state and 20 years of losing warfare, supply chain constraints caused by Covid lockdown policies, green energy policies that increase energy prices, an astronomical build-up of debt and deficits, entitlement systems vulnerable to massive demographic shifts, and a long period of loose money and zero interest rates. We are flirting with revolutionary monetary policies such as Modern Monetary Theory and a very interventionist Federal Reserve. Indeed, we are living in the echo of the longest period of zero interest rates ever in history and we have never seen the Fed expand its balance sheet to this extent and then take such large market losses in its portfolio.

Our politics appear broken, with neither party able to unite to fight chronic deficits or carry out a consistent foreign policy.

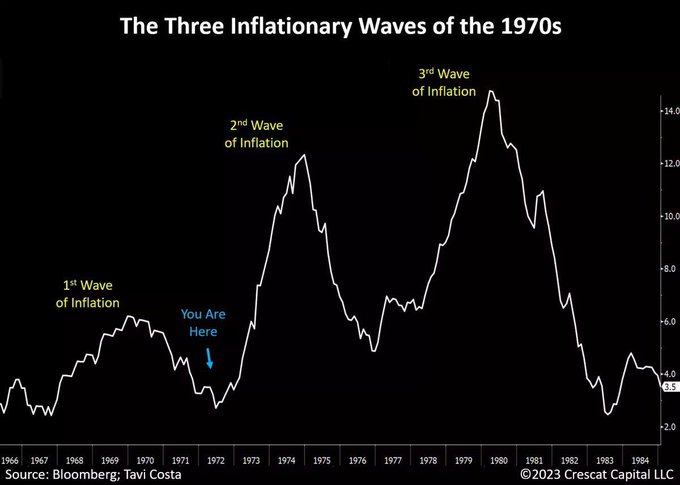

Arguably, this is worse than previous circumstances. Notice in the chart above that the ceiling for inflation (around 3%) is increasingly starting to look like a floor.

Previous periods did not have this exact combination to be sure, but we can find some similarities with the mid-1960s to the mid-1980s.

The late 60s and early 70s saw huge budget deficits caused by funding both the Great Society and Vietnam War spending. We also had political turbulence with Watergate, the resignation of President Nixon, the Church CIA hearings, and chronic troubles with Iran. There was a Mid-East War with supply constraints on oil and the rise of OPEC. In the early part of the 1970s, we had radical monetary changes with the collapse of the Bretton Woods and the end of any kind of gold standard constraint. While somewhat different from today, there also were radical social changes in music and family structure, and political unrest, including urban race riots and riots at political conventions. The stock market boomed, making a double peak in 1966-1968 but had trouble in the early 1970s. By 1973-74, stocks took their biggest hit since the Depression. They continued to struggle for almost a decade until August 1982 when rates finally peaked, and a long bull market commenced.

So, there are some fair comparisons. But there are differences, such as the rise of China, and the end of the Cold War. Moreover, debt extremes at the household, corporate, and governmental levels, are all far worse than they were 40 to 50 years ago. Given these differences, why bring this period up?

The reason is there is enough similarity in these 20 years that we should be concerned and alert to the historical record. Inflation is very difficult to kill off once it has been set loose. You can see from the chart above that inflation came in three great waves. The circumstances needed to kill it off in the early 1980s required super high interest rates, which would not sit well with the debt bubble we live with today. Having lived through that period, it was hard enough as it was.

History shows cycles of inflation and then disinflation and its persistent nature. You have to be prepared for both and knowing the timing is extremely difficult.

Right now, the widely expected “soft landing”, looks more like “no landing”, with both the economy and inflation remaining strong. A disinflationary recession may be the only way to break the fever.

The markets have been recently leaning heavily towards the idea of six or seven rate cuts just this year, but inflation has proven stubborn. That may delay and reduce the expected interest rate cuts.

There seems to be an almost universal opinion that the Fed will cut rates for reasons of the political needs of incumbents.

Yet the problem remains. Higher rates for longer could cause an unwinding of our huge debt bubble and set loose deflationary forces. The property collapse in China and the commercial real estate problems in the US are manifestations of this problem.

But capitulation on fighting inflation could make inflation worse and delay cuts in interest rates.

As our friend Wolf Richter recently noted:

“Inflation surprised in 2023 with its sharp decline, driven by the collapse in energy prices and the drop in durable goods prices. Both of them have come off huge price spikes since mid-2022, pulling down overall CPI inflation from 9.0% in June 2022 to 3.1% in January 2024. But services inflation has remained high and accelerated in late 2023, which was not surprising, and then on top of this increase, it leaped in January by an annualized rate of 8.2%.”

He also notes that energy prices are not likely to continue to decline and energy price reversal added to services inflation could prove painful. In addition, Iran’s terror proxies in the Middle East are causing ship traffic to be diverted around the Suez Canal, causing a spike in global shipping costs.

This puts the Fed in a bind, election year or not. What guidance history can provide is that inflation comes in waves, is very difficult to reduce, and the Fed will be afraid to be blamed for causing a recession.

Inflation’s influence extends beyond the grocery cart or the gas pump. It can radicalize politics, undermine hard work and long-term saving, encourage gambling and short-term thinking, and degrade social cohesion. Everyone gets desperate to keep up and financial chicanery of all kinds flourishes. Notice how much gambling is going on today, ranging from stock speculation to lotteries and sports betting.

We were struck by a car ad currently running on television. A family’s decision to sell their car, using a smartphone app, is portrayed almost like day-trading in a stock.

Democratic institutions that run on a relatively short two-year political cycle, have demonstrated the inability to stay with policies that contain inflation and bring us long periods of price stability. No politician wants to have the correction of excesses occur while running for office. Historically, price stability occurred only when there was an outside institutional constraint on political spending. But with the demise of the gold standard, we lack such institutional constraints.

We see no new ones on the horizon to replace it. The proposed answer by some has been cryptocurrency, but they have proven even more unstable than stock prices and seem far too volatile to use as currency. They seem more a product of inflation than a solution.

Central banks are supposedly “independent” and not subject to political pressure. Not only is that not true, but the dog that is supposed to protect the flock from the wolf of inflation may turn out to have an appetite for mutton.

*****

Chart Credit: Federal Reserve Bank of St. Louis and Tavi Costa Crescat Capital

Image Credit: Wikimedia Commons