AIER’s Everyday Price Index Rises a Record 12.8 Percent Over the Last 12 Months

Editors’ Note: There are different ways to calculate inflation. Unfortunately, the government tends to dominate the field with its CPI or Consumer Price Index. But the government is often not an unbiased observer. For one thing, the government changes its methodology from time to time, making historic comparisons challenging. Government historically causes inflation in most cases through excessive monetary creation to fund its chronic inability to control spending. As a consequence, they have a vested interest in downplaying the blowback they get from an angry public. In the realm of a conflict of interest, Social Security benefit adjustments are indexed to their numbers, hence they have a financial interest in understating inflation. So critics think they tinker with the data, especially using hedonic accounting. This is an attempt to correct for quality changes that occur over time. They also can manipulate the weighting of the index. They also use rental equivalence as opposed to the outright cost of real estate. AIER some years ago developed its own proprietary index and it has been quite good at assessing inflation closer to reality. Right now, they suggest prices are up over 12% while the government suggests they are up about 8.5%. That is a whopping difference of almost 50%. If you choose to accept government numbers that is your privilege. The CPI still shows a very serious inflationary problem. However, private indices show the problem is much worse, and that is a real concern. If AIER is correct, we are now in a rare double-digit inflation crisis. These levels can create social chaos as inflation is like a compound interest curve in reverse. A 10% inflation rate, would mean our money would lose half of its purchasing power in just a little over seven years. That can wipe out the savings of the middle class and lead to social revolution. It is a tremendous burden on the elderly on a fixed income who live mostly on savings. With the Biden Administration, like so many issues, a good case can be made that either it is the result of stupidity or it is intentional to create the environment for radical change. Either way, it is irresponsibility of the highest order.

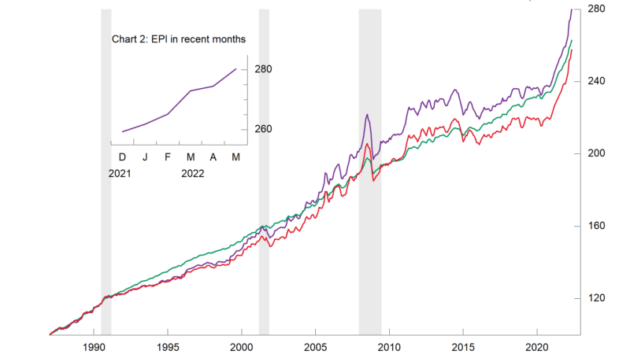

AIER’s Everyday Price surged 2.1 percent in May after a 0.5 percent increase in April, a 3.0 percent jump in March, and a 1.3 percent gain in February. Over the first five months of 2022, the EPI is up at an annualized rate of 20.6 percent. From a year ago, the Everyday Price Index is up 12.8 percent, the fastest on record dating back to 1987.

Price increases continue to be generally broad-based with 19 components showing gains versus four showing declines, and one unchanged in May. Motor fuel prices, which are often a significant driver of the monthly changes in the Everyday Price index because of the large weighting in the index and the volatility of the underlying commodity, led the gainers with a 7.8 percent rice rise for the month (on a not-seasonally adjusted basis), contributing 108 basis points to the monthly increase.

Household fuels and utilities were the second-largest contributors in May, adding 43 basis points, followed by a 34-basis-point contribution from food at home, and an 11-basis-point contribution from food away from home (restaurants). The remaining contributions were four basis points or less.

The Everyday Price Index including apparel, a broader measure that includes clothing and shoes, rose 2.0 percent in May after gaining 0.4 percent in April, 2.8 percent in March, and 1.4 percent in February, contributing to an annualized rate of rise of 20.0 percent for the first five months of 2022. Over the past year, the Everyday Price Index including apparel is up 12.2 percent, also a record high back to 1987.

Apparel prices fell 0.1 percent on a not-seasonally-adjusted basis in May. Apparel prices tend to be volatile on a month-to-month basis. From a year ago, apparel prices are up 5.0 percent.

The Consumer Price Index, which includes everyday purchases as well as infrequently purchased, big-ticket items and contractually fixed items, rose 1.1 percent on a not-seasonally-adjusted basis in May. Over the past year, the Consumer Price Index is up 8.6 percent, the fastest pace since December 1981.

The Consumer Price Index excluding food and energy rose 0.6 percent for the month (not seasonally adjusted) while the 12-month change came in at 6.0 percent. The 12-month change in the core CPI was just 1.3 percent in February 2021 and 2.3 percent in January 2020, before the pandemic.

After seasonal adjustment, the CPI rose 1.0 percent in May while the core increased 0.6 percent for the month. Within the core, core goods prices were up 0.7 percent in May and are up 8.5 percent from a year ago. Significant increases for the month were seen in used cars and trucks (1.8 percent), pet food (1.6 percent), motor vehicle parts and equipment (1.5 percent), new cars (1.1 percent), new trucks (1.0 percent), and sporting goods (0.9 percent).

Core services prices were up 0.6 percent for the month and are up 5.2 percent from a year ago. Among core services, gainers include airfares (up 12.6 percent for the month and 37.8 percent from a year ago), health insurance (up 2.0 percent and 13.8 percent from a year ago), cable and satellite television services (1.3 percent and 5.8 percent from a year ago), other lodging away from home including hotels (up 0.9 percent for the month and 19.3 percent from a year ago), car and truck rentals (up 0.8 percent and 10.4 percent from a year ago), and owners’ equivalent rent (which accounts for 23.8 percent of the CPI, rose 0.6 percent for the month and 5.1 percent from a year ago).

Price pressures for many goods and services in the economy remain elevated due to shortages of supplies and materials, logistical and supply chain issues, and labor shortages and turnover. Sustained elevated price increases are likely distorting economic activity by influencing consumer and business decisions. Furthermore, price pressures have resulted in a new Fed tightening cycle, raising the risk of a policy mistake. In addition, turmoil surrounding the Russian invasion of Ukraine and renewed lockdowns in China are sustaining a high level of uncertainty for the economic outlook. Caution is warranted.

*****

This article was published by AIER, The American Institute for Economic Research, and is reproduced with permission.